Afrobeats musician David Adeleke, better known by his stage name Davido, has declared himself to be the best Nigerian musician

Continue reading

Latest News, Entertainment, Sport and Immigration Update

Afrobeats musician David Adeleke, better known by his stage name Davido, has declared himself to be the best Nigerian musician

Continue reading

Joseph Akinfenwa Donus, better known by his stage as Joeboy, is a musician from Nigeria who has shown an interest

Continue reading

Time magazine’s 100 Most Influential People of 2024 list features only one rapper, 21 Savage, who is based in the

Continue reading

Singer Fireboy DML of Nigeria has stated time and time again that he does not play Afrobeats music. His music,

Continue reading

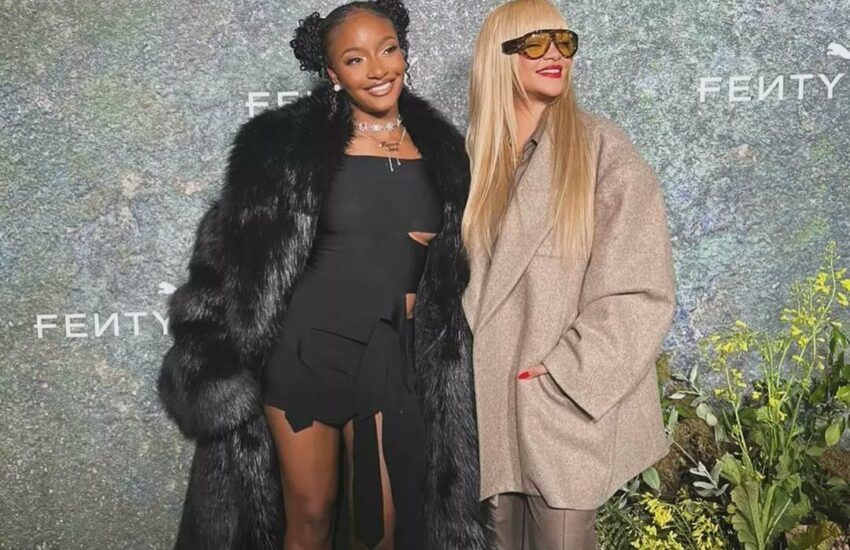

Rihanna has publicly stated her desire to collaborate with Nigerian sensation Ayra Starr, therefore Starr’s dream collaboration may soon come

Continue reading

Muslim Media Watch Group of Nigeria (MMWG), an NGO, has urged President Bola Tinubu to save Nigeria’s education system from

Continue reading

Foreign Minister Israel Katz of Israel said on Thursday that Iran poses a threat to world peace and stability like

Continue reading

The US and UK imposed sweeping penalties on Thursday on Iran’s military drone program in retaliation for the Iranian strike

Continue reading

In an effort to ensure that supermarkets around Abuja show prices and comply with quantity regulations, the Federal Competition and

Continue reading

The tensions between the two countries have been rising, and on Thursday, Iran warned that it will “reconsider” its nuclear

Continue reading